If you live in the UAE long enough, one truth becomes unavoidable: financial emergencies here don’t arrive gently.

They arrive as a rent hike notice.

A sudden visa issue.

A delayed salary.

A school fee reminder you thought was next quarter.

And yet, when we speak to residents—families, solo founders, even high earners—the phrase we hear most often is:

“I have money… but not the right kind of money.”

This is the UAE emergency fund mistake in 2026.

Not a lack of income—but misplaced confidence, frozen liquidity, and false safety nets.

Let’s break this down honestly, without bank sales language, and fix it the Finfigs way.

The UAE Emergency Fund Is Not the Same as “Savings”

Most global advice says:

“Save 3–6 months of expenses.”

That advice collapses the moment you land in the UAE.

Here, emergencies aren’t just about job loss. They’re about:

- Administrative voids (accounts frozen, visas canceled)

- Rent paid in advance

- School fees upfront

- Exit costs no one talks about

- SME cash-flow delays bleeding into family money

If your emergency fund doesn’t account for these realities, it’s not a fund—it’s a comforting illusion.

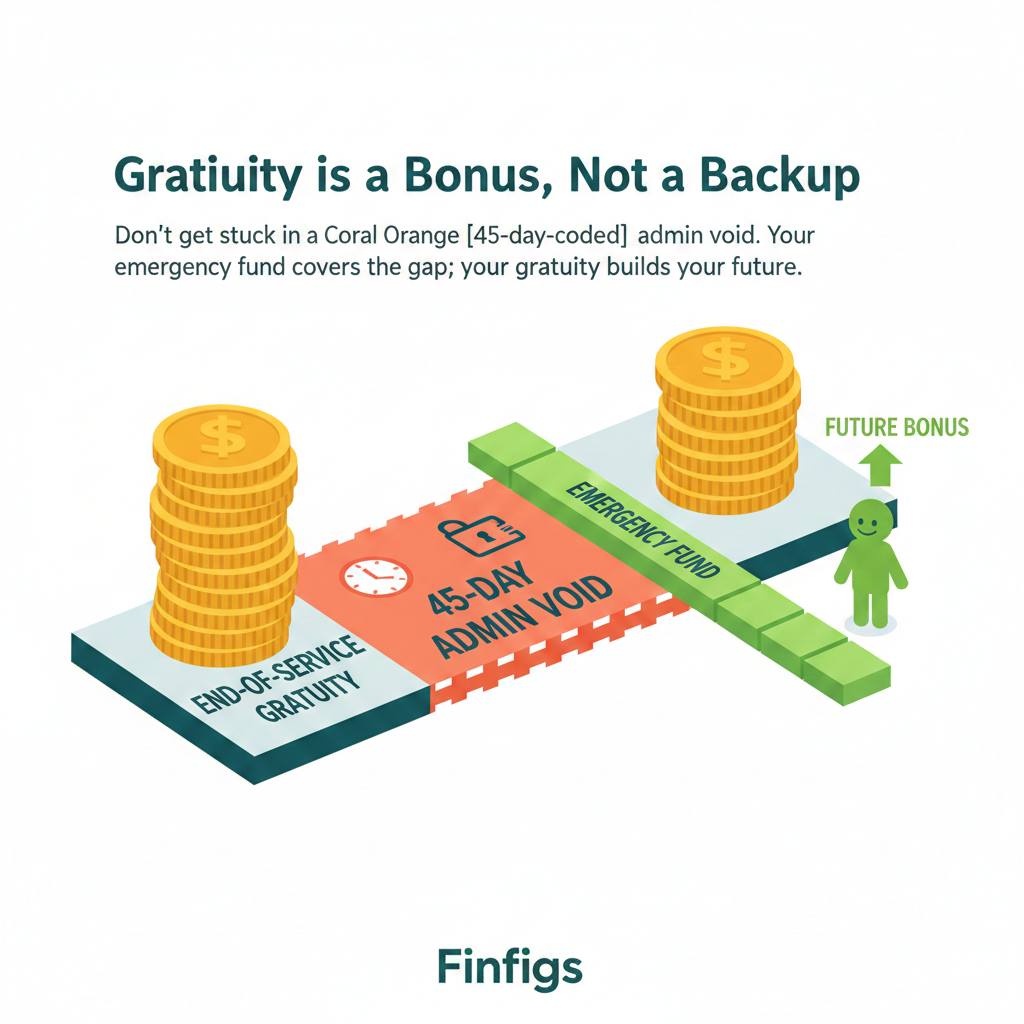

Mistake #1: Treating Gratuity Like a Safety Net

Let’s say this clearly:

Your end-of-service gratuity is not an emergency fund.

Yes, it feels guaranteed.

Yes, it’s “earned.”

Yes, it looks big on paper.

But here’s the blind spot most residents discover too late:

- Gratuity is legally capped (basic salary, not total pay)

- It’s often delayed during visa cancellation

- It arrives after the most expensive weeks of disruption

In reality, there’s a 45-day “admin void” where:

- Accounts may be restricted

- Loans auto-debit

- Rent, groceries, and school fees don’t wait

Finfigs rule:

Treat gratuity as a future bonus, not present-day protection.

Your emergency fund must stand alone—ready for the gap before gratuity ever arrives.

Mistake #2: Keeping Emergency Money Outside the UAE

This one hits expats hard.

Many residents keep 80–90% of their “emergency savings” back home:

- Higher interest

- Familiar banks

- Currency comfort

Then reality strikes.

A rent cheque is due.

School fees spike.

A medical situation appears.

And suddenly:

- Transfers take days

- FX rates eat into the amount

- Timing becomes the enemy

In the UAE, liquidity beats yield in emergencies.

Finfigs strategy: The 70/30 Split

- 30% of your emergency fund stays inside the UAE, instantly accessible

- 70% can sit offshore, earning better returns

That 30% is your fire-drill money—the cash that solves problems today, not next week.

Mistake #3: Believing ILOE Insurance Replaces an Emergency Fund

ILOE was a good move by the government.

But it was never designed to replace personal responsibility.

Here’s the uncomfortable math:

- ILOE pays 60% of basic salary

- Only for 3 months

- While UAE living costs continue rising

In 2026, that payout often doesn’t even cover:

- Rent

- Utilities

- Transport

- Groceries—let alone school fees or loans

This creates what Finfigs calls the Benefit–Expense Mismatch.

The smart approach:

ILOE reduces damage—but your emergency fund absorbs the shock.

Your fund must top up the gap between what ILOE pays and what life actually costs.

Mistake #4: Mixing Emergency Money With Daily Spending

If your emergency fund lives in the same account as:

- Your debit card

- Your Apple Pay

- Your monthly expenses

Then it’s not an emergency fund.

It’s a suggestion.

This is how people wake up thinking they have AED 50,000…

Only to realize it quietly became:

- Weekend trips

- Gadgets

- “Just this once” spending

In the UAE—where spending intent is among the highest globally—separation is survival.

Finfigs rule: Add friction.

- Use a savings-only or digital account

- No debit card

- No instant gratification

If it takes 24 hours to access, you’ll only touch it for real emergencies.

Mistake #5: Forgetting the Cost of Leaving the UAE

Most emergency plans assume you’ll stay put.

But the UAE has a unique emergency most countries don’t:

Sudden exit.

Visa cancellation.

Family emergency abroad.

Company shutdown.

Health issues.

When exit becomes urgent, costs explode:

- Flights

- Shipping

- Temporary accommodation

- School withdrawals

- Final bills

In 2025, the average exit cost for a family of four crossed AED 40,000.

Yet almost no emergency calculators include this.

Finfigs adjustment:

Your fund isn’t just “months of expenses.”

It’s:

Monthly expenses × months + exit buffer

Ignoring this turns emergencies into financial disasters.

Mistake #6: Letting the Business Eat the Family’s Safety Net

This one is specific to UAE solo founders and SME owners.

Late payments are common.

Invoices get delayed.

Cash flow tightens.

And suddenly, the line blurs:

“I’ll just borrow from my emergency fund this month.”

That’s how families lose their safety without realizing it.

Finfigs principle: The Firewall

- Personal emergency fund ≠ business survival fund

- Never cross them

- Ever

Your family’s rent money should never cover a client’s delayed payment.

If you’re a founder, you need two separate buffers—or neither truly exists.

Mistake #7: Locking Emergency Funds for an Extra 1–2% Profit

This is the most painful mistake because it starts with “being smart.”

Fixed profits look attractive:

- 4–5% returns

- Stability

- Bank reassurance

Until:

- You need the money urgently

- Breakage penalties apply

- Access is delayed

Now your “safe” fund is working against you.

Finfigs liquidity ladder approach:

- One layer: instant-access savings

- One layer: short flexible deposits

- One layer: slightly higher yield, still breakable

Emergency money should earn—but never at the cost of access.

So… How Much Emergency Fund Is Enough in the UAE?

Forget generic formulas.

The real answer depends on:

- Family size

- Rent structure

- Visa status

- Business exposure

- Exit risk

But as a practical baseline in 2026:

- Single professionals: 4–6 months + exit buffer

- Families: 6 months + school fees + exit buffer

- Founders: Personal fund + separate business buffer

If this feels higher than global advice—it’s because the UAE demands it.

The Finfigs Philosophy (Why This Matters)

Emergency funds aren’t about fear.

They’re about clarity.

Clarity to:

- Say no to panic decisions

- Negotiate calmly

- Exit on your terms

- Protect your family without stress

In the UAE, wealth isn’t built by chasing returns alone.

It’s built by controlling risk before it controls you.

And that starts with getting your emergency fund right.