If you live in the UAE, chances are you already know what you should be doing with your money. Save first. Build an emergency fund. Be consistent. Yet, month after month, the same pattern repeats: salary comes in, expenses take over, and whatever is left (if anything) gets saved.

This isn’t a discipline problem. It’s a system problem.

For UAE residents dealing with high rents, school fees, lifestyle inflation, and unpredictable expenses, manual budgeting often collapses under real life. That’s exactly why automated savings UAE strategies are becoming essential—not optional—in 2026.

This guide is written for the Executor: someone ready to act, banking app open, looking for a friction-less way to save 20% of their salary automatically without relying on motivation or memory.

The “Pay Yourself First” Philosophy — Rebuilt for the UAE

Why the traditional model fails

Most people still operate on this cycle:

Salary → Spend → Save (if possible)

In the UAE, this approach is especially fragile. Late-month expenses, impulsive weekend spending, or one large annual bill can wipe out any saving intention.

The problem isn’t awareness. It’s timing.

The system that actually works

The solution is a simple but powerful shift:

Salary → Save → Spend

Instead of hoping you’ll save later, you remove the money before life gets access to it.

In 2026, this approach is easier than ever in the UAE. With Open Finance initiatives from the Central Bank of the UAE (CBUAE), banking apps can now coordinate more smoothly across accounts, making automation reliable and trackable.

This is where automated savings UAE becomes a real, practical system—not just a concept.

Introducing “Self-Taxing”: The 20% Rule That Changes Everything

Think of saving not as an option, but as a mandatory personal tax.

Just like VAT or any statutory deduction, your savings should be non-negotiable.

What does self-taxing mean?

- You automatically divert 20% of your salary the moment it arrives.

- You never see this money in your daily spending balance.

- You design your lifestyle around the remaining 80%.

This isn’t about deprivation. It’s about structural discipline. When savings happen first, spending naturally adjusts.

One clear answer many readers search for:

How to save 20% of my salary in Dubai automatically?

Set a standing order for 20% of your salary to move out of your account the day after salary credit—before any spending begins.

Step-by-Step: How to Automate Your Savings in the UAE

This is the execution layer. No theory—just setup.

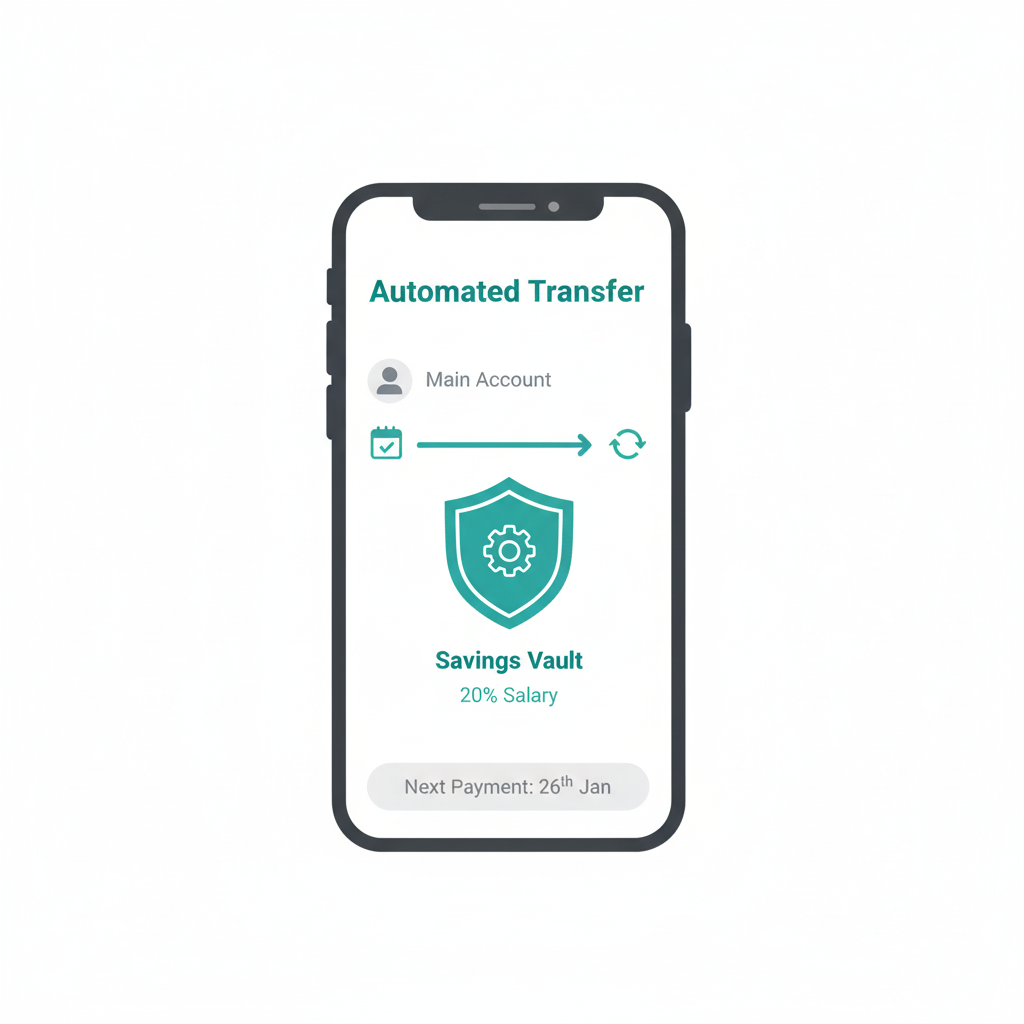

Step 1: Create a Goal-Based Savings Account or Vault

Most modern UAE banking apps allow you to create:

- Sub-accounts

- Vaults

- Pots

- Goal-based savings folders

Examples include digital-first banks and app-based accounts commonly used in the UAE.

Purpose:

This account is not for daily spending. It exists purely to receive your automated savings.

Tip:

Name it clearly:

- “20% Self Tax”

- “Emergency Buffer”

- “Do Not Touch”

Naming matters more than people realize.

Step 2: Set Up a Standing Order (This Is Critical)

A standing order is a fixed instruction you give your bank to transfer a specific amount on a specific date every month.

Standing Order vs Direct Debit (simple explanation):

- Standing Order: You control it. Fixed amount. You initiate it.

- Direct Debit: A third party pulls money. Variable amounts.

For saving, always use a standing order.

How to set it up (generic process):

- Choose transfer type: Standing Order

- Set the date: 1 day after salary day

- Amount: 20% of your net salary

- Destination: Your savings vault or separate bank account

This answers another common query:

Can I set up a standing order to another UAE bank without fees?

In most UAE banking apps, standing orders within the UAE are either free or low-cost, especially for personal accounts.

Once this is live, your saving decision is automated. You don’t “choose” to save anymore—it just happens.

Step 3: Activate the Round-Up Feature (Micro-Automation)

Many UAE banking apps now offer a round-up or “spare change” feature.

How it works:

- You spend AED 18.50 on coffee

- The app rounds it up to AED 20

- The extra AED 1.50 goes into a savings pot

This doesn’t replace your 20% self-tax. It complements it.

Round-ups:

- Capture daily spending behavior

- Build savings invisibly

- Reduce guilt-free consumption

Over a month, this can quietly add up without any effort.

Automating Your Emergency Fund (Without Temptation)

Saving is easy. Not touching it is harder.

How to isolate your emergency fund

- Keep it out of your daily banking app’s main screen

- Avoid linking it to your debit card

- Don’t mix it with general savings goals

Strategic but simple move

Use a different bank for your emergency fund than your salary account.

Why this works:

- Extra steps create friction

- You’re less likely to “borrow” from yourself

- Emergencies remain real emergencies

This aligns directly with automated savings UAE best practices—automation plus separation.

If you already have a guide on emergency funds, this is where an internal link naturally fits:

Read: Emergency Fund Basics for UAE Residents

Traditional Standing Orders vs App-Based Goal Saving

| Feature | Traditional Standing Order | App-Based Goal Saving |

| Control | Fully manual setup | Guided and visual |

| Flexibility | Fixed amount | Adjustable goals |

| Visibility | Low | High |

| Automation | High | High |

| Best for | Salary-linked saving | Behavioral motivation |

Best approach?

Use both. Standing orders for discipline. App goals for visibility and motivation.

2026 Tech Trends UAE Savers Should Leverage

AI-Driven Saving Insights

Many UAE banking apps now include AI-driven prompts such as:

- “You could have saved AED X last month”

- “Your discretionary spending increased by Y%”

You don’t need to act on every suggestion—but awareness improves behavior without spreadsheets.

Open Finance Visibility

With CBUAE-backed Open Finance frameworks:

- You can view multiple bank balances in one dashboard

- You can track whether your automated savings actually executed

- You reduce blind spots across accounts

Automation only works when it’s visible—and 2026 tech finally enables that clarity.

One-Sentence Answers

- Which UAE bank has the best app for saving goals?

Most digital-first UAE banks now offer goal-based saving features; the best app is the one you consistently use and trust. - How to save 20% of my salary in Dubai automatically?

Set a standing order for 20% of your salary to transfer the day after salary credit to a separate savings account. - Can I automate savings without tracking every expense?

Yes—automation removes the need for daily budgeting by enforcing saving first.

Final Thought: Systems Beat Motivation

If saving still depends on willpower, it will eventually fail.

By self-taxing 20% of your salary, isolating savings, and using automation tools available in the UAE today, you shift from intention to execution.

This is not about earning more.

It’s about keeping what you already earn.

Your next action

Set up one standing order today—even if it’s smaller than 20%. Systems grow stronger once they exist.

Consistency follows structure.

And structure starts with automation.