Picture this: You wake up one morning and realize your rent has been increased unexpectedly by 15%, your car breaks down, or worse—your salary has been delayed. Without a safety net, even small emergencies can throw your life into chaos. In a landscape like the UAE, where there is no funded safety net for expats and school fees are non-negotiable, building a true UAE emergency fund is not just smart—it’s a survival necessity.

In 2026, with rising living costs and the lure of “Buy Now, Pay Later” (BNPL) schemes, having a financial shield is more critical than ever. This guide will walk you through the Finfigs 3-Tier strategy, practical UAE-specific tactics, and actionable steps to secure your 6-month emergency fund efficiently.

I. The Reality Check: Why “Savings” Isn’t an Emergency Fund

Many families in the UAE believe their travel savings or home down payment funds double as an emergency fund. Reality check: they don’t. If you have to cancel your summer vacation to pay for a medical bill, you didn’t have an emergency fund—you had a vacation fund that got hijacked.

True emergencies in the UAE include:

- Sudden Job Loss: The time between your final paycheck and your next visa sponsorship.

- Bank Account Freezes: A common occurrence during job transitions or legal disputes.

- The “Summer Spike”: When DEWA bills and school term payments collide.

- Family Crises Abroad: The need for immediate international flights or medical support for parents.

The 2026 Context: Lifestyle creep is at an all-time high. With deferred spending apps, your cash is often tied up before the month even begins. Families find themselves “rich on paper” but cash-strapped when a radiator bursts or a landlord serves a 10% rent hike notice.

The Mindset Shift: Your investments are your sword (to grow wealth); your emergency fund is your shield (to protect your life).

II. Calculating Your “True” UAE Burn Rate

The biggest mistake residents make is trying to save “6 months of salary.” Instead, you should save 6 months of Survival Expenses.

The Finfigs Survival Expense Table (2026 Template)

Use this table to calculate your “Burn Rate”—the absolute minimum you need to keep your life running.

| Category | Item (Survival Mode) | Est. Monthly (AED) | Finfigs Strategy Note |

| Housing | Rent / Mortgage | 7,500 | Includes a buffer for the 2026 rent trends. |

| Utilities | DEWA / Empower / Gas | 1,200 | Weighted average to include summer peaks. |

| Connectivity | Basic Mobile & Home Wifi | 600 | Essential for job hunting/communication. |

| Groceries | Essentials (Co-op prices) | 2,500 | Shopping at Union/Sharjah Coop. |

| Education | Term Tuition Installment | 2,000 | (Total Annual Fees ÷ 12). |

| Transport | Fuel / Nol / Insurance | 1,000 | Basic commuting costs only. |

| Legal/Admin | Visa / Renewals Buffer | 200 | A monthly “sinking fund” for visa status. |

| TOTAL | Monthly Burn Rate | AED 15,000 | The amount needed to survive 1 month. |

Calculation: AED 15,000 x 6 Months = AED 90,000 Target – Your 6-month burn rate

III. The Finfigs 3-Tier Architecture: Your Emergency Shield

Saving in a single account is risky. The Finfigs 3-Tier Strategy creates redundancy and resilience by spreading your shield across different “access points.”

Tier 1 – The “Immediate Buffer” (1 Month)

Purpose: Instant crisis management. Target Amount: 1 Month of “Survival Expenses” (e.g., AED 15,000).

This is your first line of defense. It is for emergencies that require payment right now—such as a major car repair, an emergency flight ticket, or a sudden medical co-payment.

- Where to keep it: A separate, high-access digital bank account (e.g., Wio, Liv, or Mashreq Neo). It must have a dedicated debit card.

- Key Rule: It must be accessible 24/7/365. Do not keep this in your main “salary” account, as it is too easy to accidentally spend it on groceries or dining out.

- The “Safety” Factor: Since UAE banks can sometimes freeze accounts during a job change (until the first salary from the new employer hits), having Tier 1 in a separate digital bank ensures you have cash for daily survival during that transition period.

- Ethical Example – The “Broken vehicle”: Sarah, a teacher in Sharjah, finds her car transmission has failed (AED 4,000). Instead of using a high-interest credit card, she uses her Tier 1 debit card. She remains debt-free and simply refilled the buffer the next month.

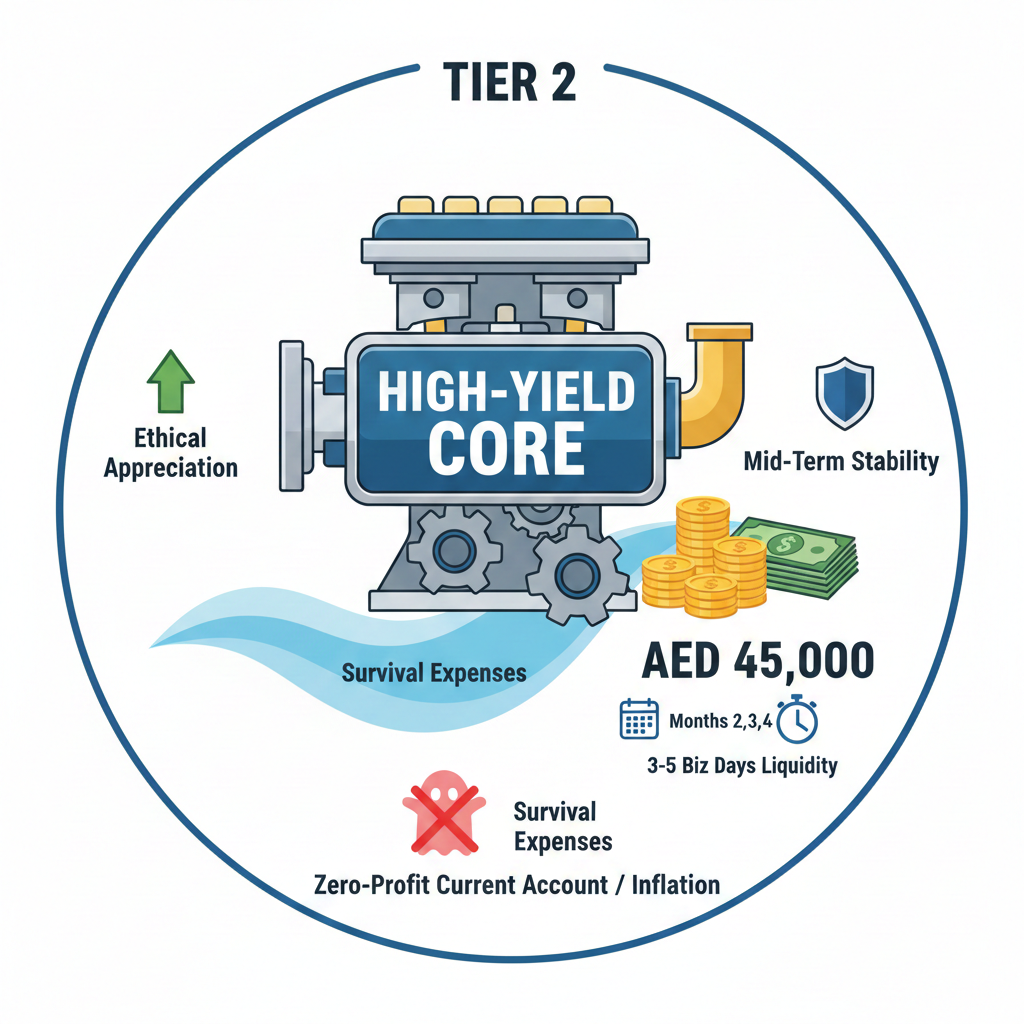

Tier 2: The “High-Yield Core” (Months 2, 3, and 4)

Purpose: Ethical appreciation and mid-term stability. Target Amount: 3 Months of “Survival Expenses” (e.g., AED 45,000).

This is the “engine room” of your emergency fund. It is too large to sit in a zero-profit current account where inflation would eat its value, but it must still be liquid enough to access within 3 to 5 business days.

- Where to keep it: Sharia-compliant, liquid assets like National Bonds (Sukuk) or high-yield “Mudarabah” savings accounts.

- The Ethical Strategy: We avoid interest-based (Riba) accounts. Instead, we use “Profit Sharing” models. Your money is used to fund real-world assets (like infrastructure or trade), and you receive a share of the profit generated.

- The “Safety” Factor: This layer protects you against a prolonged period of unemployment. Because it earns a profit, the “purchasing power” of your emergency fund grows alongside the UAE’s economy.

- The “Ethical Growth” Engine: Participating Without Interest: To truly protect your family, your shield must appreciate to combat inflation. We advocate building this through ethical, profit-sharing models (Mudarabah) rather than traditional lending. By participating in liquid, Sharia-compliant assets like Sukuk, you become a partner in economic growth, ensuring your returns are Halal and tied to tangible assets.”

- Ethical Example – The “Founder’s Pivot”: Ahmed runs a startup in Dubai. A major client delays a payment. To ensure his assistant receives their salary on time, Ahmed draws from his Tier 2 profit-sharing pool, protecting his employee’s livelihood without interest-bearing loans.

Get our blogs right into your inbox

Tier 3: The “Stable Offshore Layer” (Months 5 and 6)

Purpose: Geographic redundancy and “Fail-Safe” protection. Target Amount: 2 Months of “Survival Expenses” (e.g., AED 30,000).

This is your “ultimate” shield. It is specifically designed for expats and business owners who need to ensure that their family is protected even if something happens to their legal status in the UAE.

- Where to keep it: An offshore bank account (e.g., Jersey or Isle of Man) or a stable account in your home country, preferably in a strong currency like USD, EUR, or GBP.

- The Strategy: This money is not for daily use. It is there to ensure that if you ever have to leave the UAE suddenly, or if your local accounts are tied up in a legal or labor dispute, you have a “lifeboat” waiting for you in another jurisdiction.

- The “Safety” Factor: It bypasses the “single point of failure” risk. If your UAE accounts are frozen for 30 days during a job handover, Tier 3 ensures you can still pay for your family’s global needs (like home-country mortgages or tuition) without interruption.

Ethical Example – The “Parental Care”: An expat family in Abu Dhabi learns a parent back home needs surgery. Because they have Tier 3 funds in their home-country account, they pay the hospital fees instantly, bypassing international wire delays and exchange rate gouging.

| Feature | Tier 1 (Immediate) | Tier 2 (Core) | Tier 3 (Offshore) |

| Access Time | Seconds (Debit Card) | 3-5 Business Days | 5-7 Business Days |

| Primary Goal | Speed | Ethical Growth | Global Security |

| Typical Tool | Digital Bank App | Sukuk / Profit Sharing | Home Country / Offshore |

| Stress Level | High (Broken car) | Medium (Job loss) | Low (Long-term transition) |

IV. Innovative Tactics for Faster Funding

- The Rent Negotiation Windfall: Divert any rent savings from our “Negotiation Tactics” guide straight to Tier 2.

- The “Nol & Coop” Sprint: Commit to public transport and community cooperatives (Union/Sharjah Coop) for 90 days. Divert the 30% savings straight to your fund.

- Automating the “Invisible” Dirham: Set up an auto-transfer the day before your DEWA is due. If you pay yourself first, the money becomes “invisible” to your lifestyle.

Where the UAE residents consume their emergency funds due to the actual emergencies occurred, it is also worth that you really think on rebuilding that emergency fund. Read our blog on the guide to rebuild the emergency fund.

V. Conclusion: Breathing Again

Imagine waking up in 2026 knowing that no matter what happens, your family is protected for 180 days. Your emergency fund isn’t just a number; it’s the gift of sleep. Start building your shield—one dirham at a time.

Call to Action: Check our 2026 UAE Expense Tracker on finfigs.com to find your burn rate today.

Read our blog – The 2026 Guide to Emergency Fund in the UAE: Financial Literacy That Protects Your Visa, Income & Peace of Mind

Disclaimer: The information provided on finfigs.com is for educational purposes and does not constitute professional financial advice. Always consult with a licensed financial advisor before making significant investment decisions.