Financial literacy in the UAE has evolved rapidly over the last few years. In 2026, saving money is no longer just about being “responsible” — it’s about staying employable, solvent, and legally secure in one of the world’s most opportunity-rich but unforgiving residency systems.

If you’re an expat or resident in the UAE, an emergency fund is not optional. It’s your financial oxygen mask.

At Finfigs, we don’t believe in vague advice like “save more”. This guide is designed to move you from:

❌ “I know I should save”

✅ “I have a UAE-proof emergency fund plan.”

The 2026 Reality Check: Why Emergency Funds Matter More Than Ever

The UAE economy in 2026 remains structurally strong — stable currency, continued infrastructure spending, and a growing digital and services sector.

However, living costs have stabilized at a much higher plateau:

- Rents reset upward post-2024 and haven’t meaningfully come down

- School fees remain sticky and contract-based

- Health insurance premiums are rising faster than salaries

- Job cycles are faster — but also more volatile

The UAE-Specific Risk Most People Ignore

In most countries, job loss is a financial inconvenience.

In the UAE, it is a legal countdown.

Once your income stops:

- Your employer-sponsored visa starts a 30–60 day clock

- Rent, utilities, school fees, and loan EMIs do not pause

- You need liquidity before any paperwork is processed

Critical Reality:

An emergency fund in the UAE is not for a “rainy day”.

It is Visa Security.

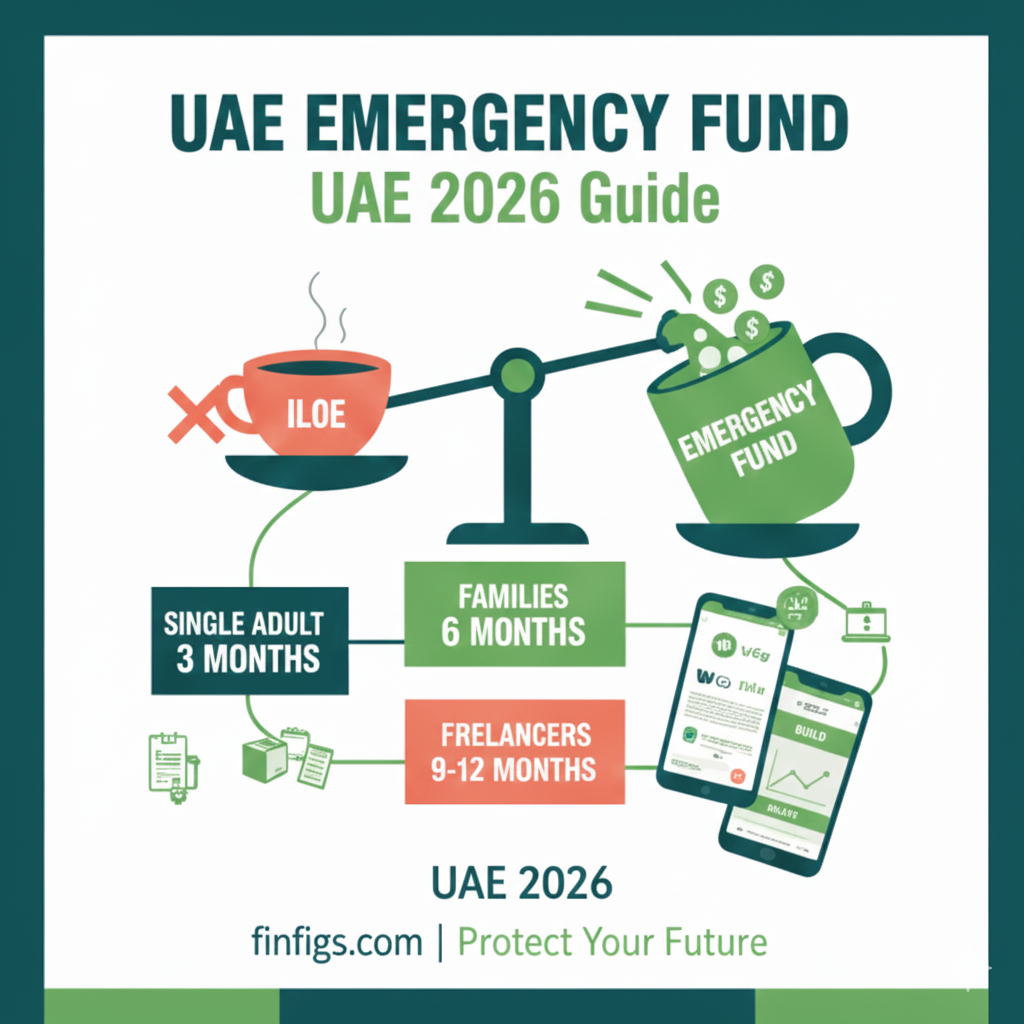

What About ILOE (Unemployment Insurance)?

ILOE is helpful — but dangerously misunderstood.

- Covers 60% of basic salary

- Maximum payout duration is limited

- Excludes allowances (housing, transport, education)

Don’t Miss This:

ILOE is a cushion, not a couch.

Your emergency fund must carry your lifestyle — ILOE only softens the fall.

The UAE Buffer Formula: How Much Should You Really Save?

Most global blogs recommend the “3-month rule”.

In the UAE, that advice is incomplete and risky.

Finfigs uses a life-stage-based buffer model.

Also read out our blog The 180-Day Shield: Building a Fail-Safe UAE Emergency Fund in 2026 for the Finfigs 3-Tier Strategy that creates redundancy and resilience by spreading your shield across different “access points.”

Emergency Fund Tiers (UAE-Specific)

1. Single Expats (Salaried) — 3 Months Minimum

You need:

- 3 months of total living expenses

- Plus: One-way flight to home country

Why?

- Faster re-employment

- Lower fixed commitments

- More flexibility to downgrade lifestyle

2. Families with Children — 6 Months

You need:

- 6 months of full household expenses

- Coverage for:

- School fees (mid-term exits)

- Rent renewal overlaps

- Medical insurance continuity

- School fees (mid-term exits)

Families face non-negotiable costs even during unemployment.

3. Freelancers, Consultants & SME Owners — 9 to 12 Months

You need:

- 9–12 months due to:

- Delayed client payments

- Seasonal cash flow

- Contract uncertainty

- Business overheads

- Delayed client payments

Freelancers in the UAE don’t lose income — they lose predictability.

The Forgotten Cost: Repatriation Buffer

Every UAE emergency fund must include:

- Shipping belongings

- Final DEWA/ADDC settlement

- Etisalat/Du cancellations

- Agent fees

- Exit penalties

Ignoring this is one of the biggest emergency fund mistakes expats make.

Monthly Expense Checklist (UAE)

| Expense Category | Included in Emergency Fund? |

| Rent / Housing | ✅ |

| DEWA / ADDC | ✅ |

| Internet & Mobile | ✅ |

| Groceries | ✅ |

| Transport / Fuel | ✅ |

| School Fees | ✅ (Families) |

| Insurance | ✅ |

| Minimum Debt Payments | ✅ |

| Repatriation Costs | ✅ |

Finfigs Rule:

If an expense can’t be paused within 30 days, it must be funded.

Where to Park Your Emergency Fund in 2026 (UAE)

Emergency funds are not investments.

The goal is liquidity first, yield second.

Best Places to Save for Emergencies in the UAE

1. Digital Banks Accounts (Separate from your main account)

Popular in 2026:

- Wio

- Liv

- Mashreq Neo

Features:

- No lock-in

- App-based withdrawals

- Separate “vaults” for mental accounting

Perfect for discipline without sacrificing access.

2. Sukuk (Capital Protection)

Good for:

- Ethical savers

- People tempted to overspend liquid cash

Pros:

- Capital protection

- Prize incentives

- UAE-backed credibility

Cons:

- Slightly slower liquidity than digital banks

The Finfigs Split Strategy

- 20% → Current account (instant ATM access)

- 80% → digital vault

This prevents:

- Panic withdrawals

- Lifestyle creep

- Missed interest earnings

We have mentioned another way to pile up your emergency fund in our blog ‘The 180-Day Shield: Building a Fail-Safe UAE Emergency Fund in 2026’ where we explain you the Finfigs 3-Tier strategy, practical UAE-specific tactics, and actionable steps to secure your 6-month emergency fund efficiently.

Advanced UAE Money Management Tactics (That Actually Work)

Saving Tip #1: The Rent-Cheque Hack

Most landlords prefer fewer cheques.

Strategy:

- Save aggressively to move from 4 cheques → 1–2 cheques

- Negotiate 5–10% rent discounts

That discount alone can:

- Fund 1–2 months of emergency savings annually

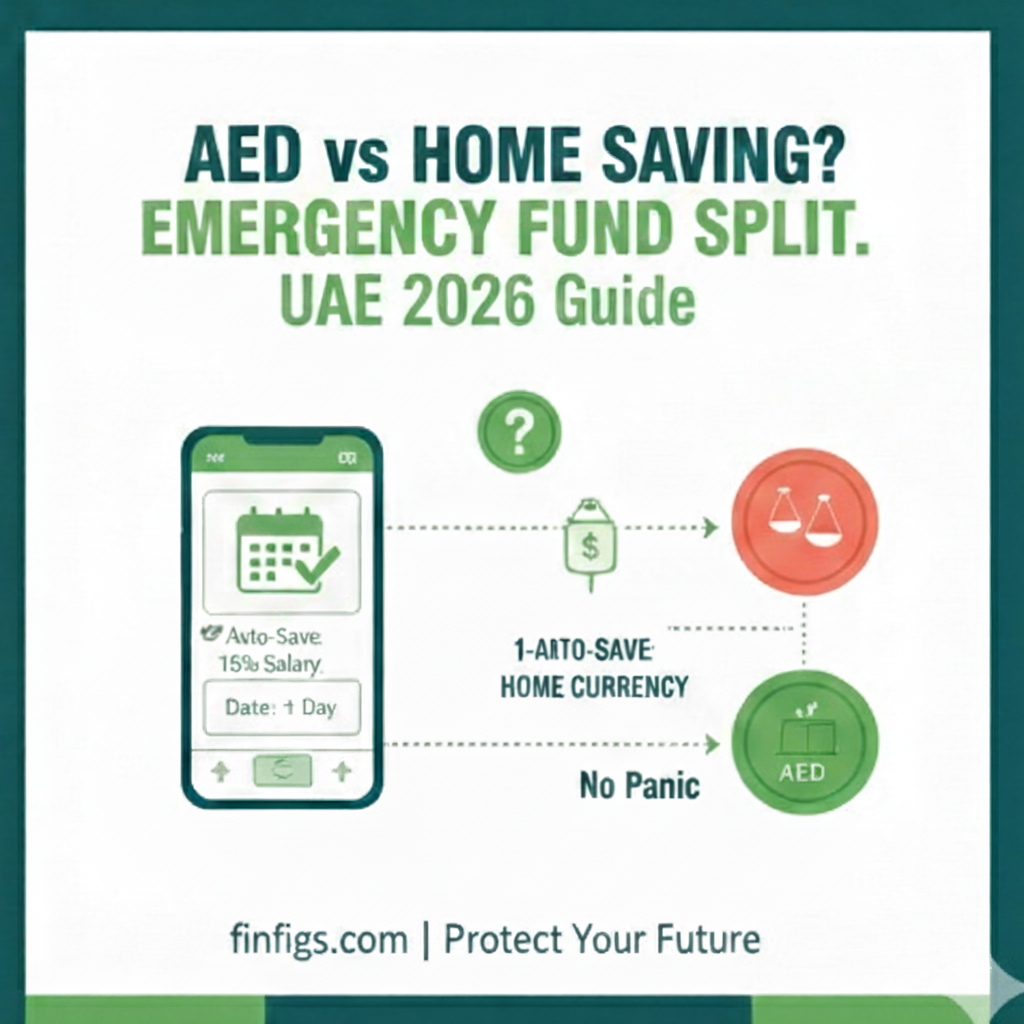

Saving Tip #2: Automate the Day After Salary Credit

Never save “what’s left”.

Set:

- Standing order

- Day +1 after salary credit

- Fixed percentage (10–25%)

Automation removes:

- Emotional decisions

- Willpower dependency

Saving Tip #3: Currency Diversification (Done Right)

Common question: “Should I keep some savings in my home currency?”

Finfigs recommendation:

- Majority in AED

- Small buffer in home currency only if:

- You have overseas dependents

- You anticipate repatriation soon

- You have overseas dependents

Local emergencies require local liquidity — not remittance delays.

AI-Driven FAQ: Real Questions UAE Residents Ask in 2026

Should I pay off my credit card before building an emergency fund?

No — not immediately.

Correct order:

- Build 1 month of emergency buffer

- Then aggressively clear high-interest debt (Finfigs encourages its audience to stay debt free. That impacts you to be stress free too)

- Expand emergency fund to full target

Why?

- Debt is expensive and stressful

- But zero liquidity is dangerous

Can I use my End of Service Gratuity as an emergency fund?

Absolutely not.

Reasons:

- You receive it after job loss

- Processing delays are common

- It may be partially used to settle liabilities

Emergency funds must be available during the transition, not after it.

Is a credit card my emergency fund?

No.

Credit cards:

- Increase risk during unemployment

- Accrue compounding interest

- Reduce future borrowing ability

Credit is a tool, not a safety net. Remaining on cash dealings is always safer for people rather than being into the credit card stress.

The Finfigs Emergency Fund Philosophy (Final Word)

In the UAE, financial literacy is not about wealth — it’s about resilience.

A solid emergency fund gives you:

- Negotiating power

- Career flexibility

- Visa breathing room

- Mental clarity under stress

Finfigs Principle:

Money doesn’t reduce problems.

Liquidity reduces panic.

If you master this one foundation, every other financial goal becomes easier whether it is investing, business, relocation, or lifestyle upgrades.

Next on Finfigs

Read our blog How to Rebuild Your Emergency Fund After a Major UAE Expense for rebuilding the emergency fund in case of any consumption

Finfigs is an informational platform. Content is educational and non-advisory.