Let’s be honest.

Most people in the UAE aren’t trying to “build a startup” when they Google freelancing in UAE. They’re trying to breathe.

Between rent renewals that feel like negotiations with fate, school fee emails that arrive every year like clockwork, and grocery bills that quietly climbed 20–30% since 2023, the math just isn’t mathing anymore.

So people look inward and ask a very reasonable question:

“I have skills. I have evenings. Why does earning a small side income feel so risky here?”

That question — not ambition — is what drives the surge in freelancing and side hustles across the UAE in 2026.

This guide is for people like us:

- Full-time employees

- Parents and providers

- Mid-career professionals

- Residents who want to stay legal without burning their first year’s profits

We won’t sell you a license.

We won’t scare you with jargon.

And we won’t pretend freelancing is “easy money.”

We’ll show you how it actually works — and when it actually makes sense.

The Real Problem Isn’t Freelancing. It’s the Cost of Being Honest.

On paper, the UAE supports freelancing.

In reality, the entry cost feels backwards.

Many legal freelance permits cost between AED 7,500 and AED 15,000 — before you’ve earned a single dirham. For someone testing a side gig that might bring in AED 2,000–3,000 per month initially, that’s not a business decision. That’s a gamble.

This is why a quiet truth exists in forums, WhatsApp groups, and coffee shop conversations:

People aren’t avoiding freelancing because they lack skills.

They’re avoiding it because the legal cost arrives before proof of income.

And that creates a dangerous gray zone — shadow freelancing, unpaid work, or delaying income entirely out of fear.

Most blogs stop at listing license prices. That’s not helpful.

What actually matters is timing.

The Finfigs Threshold: When Does a License Become Non-Negotiable?

Here’s a simple concept most guides avoid because it doesn’t sell licenses:

You don’t need a license on day one to learn.

You need a license when money becomes predictable.

We call this the Legal Green Zone.

If your projected annual side income is still under a level where license costs eat more than 15% of your yearly freelance revenue, you are mathematically punishing yourself by rushing into setup.

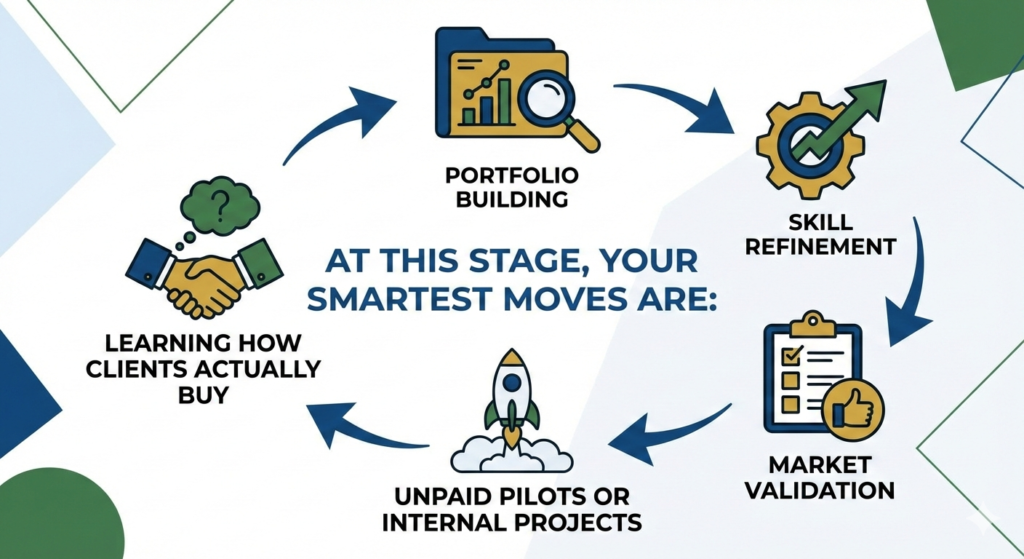

At this stage, your smartest moves are:

- Portfolio building

- Skill refinement

- Market validation

- Unpaid pilots or internal projects

- Learning how clients actually buy

Once your income crosses a consistent threshold — not a lucky one-off — legality becomes protection, not punishment.

At that point, the goal isn’t “any license.”

The goal is the most surgical license that keeps your margins intact.

This is where options like specific Ajman freelance categories quietly outperform flashy Dubai setups — something consultants rarely explain because it doesn’t maximize their commission.

“But I’m Employed.” The NOC Anxiety Is Real.

For employees, freelancing fear doesn’t start with money.

It starts with HR.

Many contracts are vague.

Many managers are old-school.

And many employees worry that even asking for an NOC signals disloyalty.

This fear is rational.

But here’s the mistake most people make:

They frame freelancing as outside work instead of professional development.

Before you even speak to your employer, audit your contract properly:

- Non-compete ≠ Non-disclosure – A Non-disclosure Agreement (NDA) protects secrets (your boss’s client list or proprietary software), while a Non-compete protects market share. You can absolutely freelance in a different niche without ever touching your employer’s “secret sauce.” If you work in HR and freelance as a wedding photographer, there is zero crossover.

- Skill usage ≠ client poaching – Your talent is your own; your employer’s rolodex is theirs. Using your coding skills to build an app for a client in Singapore is “skill usage.” Pitching that same app to your employer’s direct competitor in Dubai is “poaching.” As long as the territory or audience doesn’t overlap, you are generally in the “Green Zone.”

- Side income ≠ conflict of interest – A conflict only arises if your side hustle actively drains the company’s resources or time. If you are building your empire at 8:00 PM on a Saturday, you aren’t “conflicted”—you are ambitious.

Most people confuse these.

Instead of asking, “Can I freelance?”, the smarter framing is:

“I’m developing skills that improve my market relevance and directly benefit my role here. I want clarity on boundaries so I stay compliant.”

This shifts the conversation from risk to value.

In a 2026 market where skills age fast, employers increasingly understand that stagnation is more dangerous than growth — especially if your side work doesn’t touch their clients, data, or time.

The Corporate Tax Panic (That’s Mostly Unnecessary)

Few things scared freelancers more in the last two years than one number:

AED 375,000

The introduction of UAE Corporate Tax triggered panic well beyond its actual impact — especially among people earning small side income.

Here’s the grounding truth:

- The 9% corporate tax applies only after crossing the AED 375,000 profit threshold

- Most side hustlers don’t come close — especially in year one or two

- Salary income and freelance income are treated differently

- Simplified compliance exists for small operators

Yet many people freeze because they imagine “accounting hell” for a hobby-level income.

Instead of legal jargon, here’s the mental model that matters:

If your freelance income is still smaller than your annual rent increase, you are not the tax problem the internet makes you think you are.

The UAE’s 2026 framework — when understood properly — is actually more freelancer-friendly than many Western systems. The problem is communication, not policy.

Getting Paid: The “Ghost Client” Problem No One Warns You About

Another harsh reality hits once you actually land work:

Clients are happy to hire you.

They’re slow to pay you.

Without a company bank account, freelancers often feel invisible — especially when dealing with SMEs or overseas clients who default to rigid accounting processes.

Opening a traditional business bank account sounds like the solution… until you see:

- High minimum balances

- Long approval timelines

- Rejections for “small activity”

This is where many give up.

The smarter route in 2026 is hybrid payment stacking:

- Understanding when personal accounts are legally acceptable

- Using UAE-friendly fintech intermediaries

- Creating payment rails that feel “corporate enough” for clients without drowning you in overhead

This middle layer is growing fast — but still poorly explained online.

“Isn’t the Freelance Market Saturated?”

Short answer: Yes — and no.

General titles are crowded:

- Social media manager

- Business consultant

- Life coach

But demand hasn’t disappeared. It has shifted sideways.

While everyone chases global trends, the UAE quietly lacks:

- Arabic-first content specialists

- Fractional operations experts for SMEs

- Industry-specific automation builders

- Localized AI workflow designers

- Compliance-aware freelancers who understand regional nuance

The opportunity isn’t in copying what’s popular.

It’s in localizing what works elsewhere before it becomes mainstream here.

Many of today’s “oversaturated” professions were once invisible niches.

Timing beats originality.

Why Most People Aren’t Freelancing for Luxury

Here’s the part most blogs miss completely.

Side income in the UAE is rarely about vacations.

It’s about pressure relief.

- School fee increases

- Rent renewals

- University planning

- Emergency buffers

Freelancing, for many families, has become a financial hedge, not a passion project.

When viewed this way, everything changes:

- Income gets ring-fenced, not spent

- Risk is calculated, not romanticized

- Growth is paced, not rushed

This is why at Finfigs, we don’t talk about side hustles as “extra cash.”

We treat them like micro-funds — income streams with a job to do.

So… Can You Freelance in the UAE Without Ruining Your Life?

Yes.

But not the way most guides sell it.

The real path looks like this:

- Skill clarity before legal commitment

- Proof before paperwork

- Margin before marketing

- Structure before scale

Freelancing in the UAE isn’t broken.

It’s just misunderstood.

And once you understand the thresholds, the rules, and the timing, it stops feeling like a legal minefield — and starts feeling like what it was meant to be:

A controlled way to regain financial breathing room.

Final Thought

If you’re reading this in 2026, chances are you’re not lazy.

You’re cautious.

That’s not weakness.

That’s intelligence.

And with the right strategy, caution doesn’t slow you down — it keeps you standing.

The Wealth Leak: How to Track Spending in UAE the “Smart Way” in 2026

7 Critical UAE Emergency Fund Mistakes Costing Residents Thousands (2026 Guide)

If you live in the UAE long enough, one truth becomes unavoidable: financial emergencies here don’t arrive gently. They arrive as a rent hike notice.A sudden visa issue.A delayed salary.A school fee reminder you thought was next quarter. And yet, when we speak to residents—families, solo founders, even high earners—the phrase we hear most often…

The 2026 Guide to Freelancing in the UAE: How to Build Side Income Without the Legal Headaches

Let’s be honest. Most people in the UAE aren’t trying to “build a startup” when they Google freelancing in UAE. They’re trying to breathe. Between rent renewals that feel like negotiations with fate, school fee emails that arrive every year like clockwork, and grocery bills that quietly climbed 20–30% since 2023, the math just isn’t…

Automated Savings UAE: How to Pay Yourself First Without Willpower in 2026

If you live in the UAE, chances are you already know what you should be doing with your money. Save first. Build an emergency fund. Be consistent. Yet, month after month, the same pattern repeats: salary comes in, expenses take over, and whatever is left (if anything) gets saved. This isn’t a discipline problem. It’s…

The Ultimate UAE Emergency Fund Checklist: From Rent to Repatriation

Living in the UAE comes with undeniable advantages—tax-free income, modern infrastructure, safety, and access to global opportunities. For many residents, Dubai or Abu Dhabi is not just a workplace but a carefully built life. However, there is an unspoken rule that every expat eventually learns: financial stability in the UAE is directly tied to residency…

The 2026 UAE Budgeting Masterguide: How to Beat Lifestyle Creep and Build Wealth in the Emirates

If you live in the UAE, earn a decent salary, and still find yourself “cash-poor” by the 25th of every month, this guide is for you. You’re not irresponsible.You’re not bad with money.You’re operating in one of the most expensive, consumption-driven economies in the world—without a budgeting system built for it. Most online advice on…

How to Rebuild Your Emergency Fund After a Major UAE Expense

A practical recovery guide for UAE residents There is a moment many UAE residents know too well. You open your banking app after a major payment clears — the rent cheque, annual school fees, car insurance renewal, or a medical expense — and the number staring back at you feels uncomfortable. Your emergency fund, once…

How to Save Money on Groceries in UAE (2026 Guide): The Finfigs Strategy

The UAE grocery landscape in 2026 is a paradox. While official food inflation is projected to stabilize around 2.7%, anyone walking down a supermarket aisle in Dubai or Abu Dhabi knows the “receipt reality” feels much heavier. Between the subtle “shrinkflation” of your favorite biscuits and the 15% convenience markup on delivery apps, your monthly…

The 2026 Guide to Emergency Fund in the UAE: Financial Literacy That Protects Your Visa, Income & Peace of Mind

Financial literacy in the UAE has evolved rapidly over the last few years. In 2026, saving money is no longer just about being “responsible” — it’s about staying employable, solvent, and legally secure in one of the world’s most opportunity-rich but unforgiving residency systems. If you’re an expat or resident in the UAE, an emergency…

UAE Cost of Living Breakdown 2026: The Ultimate Guide to New Rules, Rents, and Hidden Costs

The UAE in 2026 remains a global beacon of safety, infrastructure, and career opportunity. However, the economic landscape has shifted from a “simple tax haven” to a “sophisticated global financial hub.” This transition has introduced a phenomenon known as “Cost Creep”—the gradual rise of baseline living expenses driven by new regulatory frameworks, environmental levies, and…