If you live in the UAE, earn a decent salary, and still find yourself “cash-poor” by the 25th of every month, this guide is for you.

You’re not irresponsible.

You’re not bad with money.

You’re operating in one of the most expensive, consumption-driven economies in the world—without a budgeting system built for it.

Most online advice on how to budget for monthly expenses in UAE is recycled bank content: generic rules, unrealistic ratios, and zero understanding of rent cheques, school fee lump sums, district cooling, or lifestyle pressure.

This is different.

This is a real-world UAE budgeting Masterguide for 2026, built for expats and families who want to enjoy life here without constantly feeling behind.

Why Budgeting in the UAE Feels Harder Than Anywhere Else

On paper, the UAE should be a saver’s paradise:

- Tax-free income

- High earning potential

- Strong banking infrastructure

Yet surveys and community forums consistently show the opposite:

“I earn well, but I save nothing.”

That disconnect comes from three UAE-specific realities most budgeting guides ignore:

- Expenses are annual, but income is monthly

- Lifestyle creep is baked into daily life

- Hidden and seasonal costs destroy predictability

To truly understand how to budget for monthly expenses UAE, you must first acknowledge these structural issues.

Pain Point #1: The UAE “Lump Sum” Trap (Annual vs Monthly Reality)

The Problem

In most countries, expenses are spread evenly.

In the UAE, some of the biggest costs hit all at once:

- Rent (1–4 cheques)

- School fees (term-wise)

- Car insurance & registration

- Annual flights home

- Visa renewals

Families budget carefully for groceries and fuel…

Then panic when a AED 15,000 school invoice lands or a AED 5,000 car renewal appears “out of nowhere.”

The Emotion

Anxiety.

It feels like a financial emergency—even when the expense was predictable.

The Reality (2025–2026 Data)

- Mid-market rents in areas like JVC, Mirdif, Al Nahda rose 15–20%

- Over 40% of UAE residents admit using credit cards to manage lump-sum months

- Emergency funds are often used just to maintain the same lifestyle

The Gap

Most guides still push the 50/30/20 rule, which collapses in a cheque-based economy.

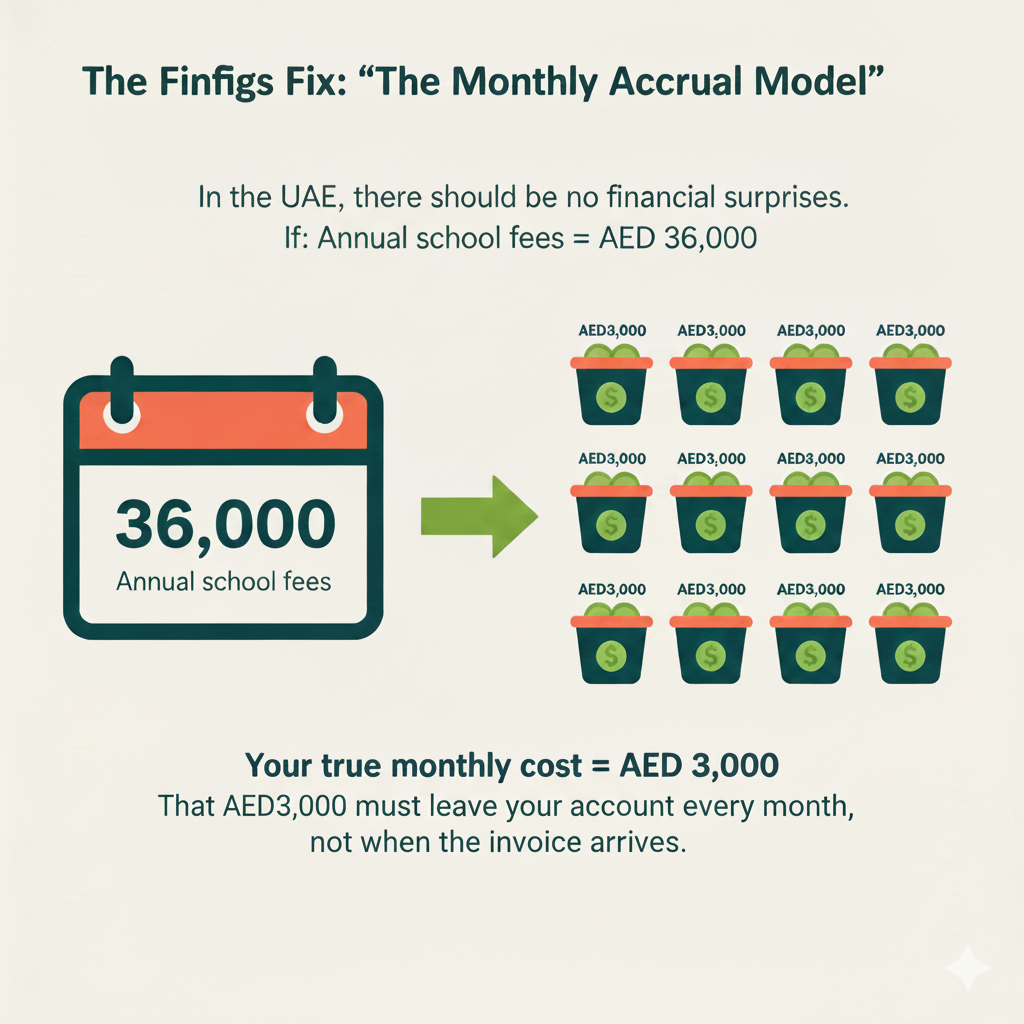

The Finfigs Fix: The Monthly Accrual Model

In the UAE, there should be no financial surprises.

If:

- Annual school fees = AED 36,000

Then: - Your true monthly cost = AED 3,000

That AED 3,000 must leave your account every month, not when the invoice arrives.

This is done through Sinking Funds—dedicated savings buckets for known annual costs.

Reality check:

Are you currently tracking these as “one-offs,” or as monthly expenses?

Pain Point #2: Lifestyle Creep & Social Comparison

The Problem

The UAE doesn’t just allow lifestyle upgrades—it normalizes them.

- Weekend brunches

- Staycations

- Premium groceries (Spinneys, Waitrose)

- Constant food delivery

- Social expectations

What starts as “once in a while” becomes routine.

The Emotion

Guilt and frustration.

You feel:

- You should be saving more

- Cutting back feels like social isolation

- Saying “no” feels like failure

The Reality (2025–2026)

- UAE ranks among the highest globally for luxury and dining spending intent

- Reddit threads are full of:

“I earn 30k and save zero—how?”

The Gap

Advice says: “Stop eating out.”

No one explains how to enjoy the UAE without sabotaging your future.

The Finfigs Fix: Reverse Budgeting

Instead of tracking every dirham you spend:

- Automate savings first

- Lock in investments on salary day

- What remains is guilt-free spending

If the money is there—you spend it.

If it’s not—you wait.

No guilt. No tracking fatigue.

Luxury brunches don’t disappear.

They just compete with other priorities.

Pain Point #3: Hidden Utilities & Subscription Fatigue

The Problem

UAE utilities are not stable month to month.

- DEWA/FEWA fluctuates

- District cooling (Empower, Emicool) spikes in summer

- Summer bills can be 3x winter costs

Add:

- Netflix

- Amazon

- Gym memberships

- Meal plans

- Kids’ activities

And suddenly:

“Where did my money go?”

The Reality

- Utility volatility is a top cashflow stressor

- Subscription spending quietly reaches four figures annually

- Cashflow blindness stops people from investing—even when they want to

The Gap

Most budgeting apps don’t handle district cooling properly.

The Finfigs Fix: The Seasonal Baseline

Instead of paying variable amounts:

- Calculate your highest summer bill

- Pay that amount every month

- Build a credit during winter

This removes the July/August shock completely.

The Finfigs Step-by-Step UAE Budgeting Method (2026)

Step 1: Define Your “True” Income

Include:

- Base salary

- Housing allowance

- Car allowance

- Average annual bonus (smoothed monthly)

Families should look at household income, not individual.

Step 2: Audit the UAE “Big Five” Fixed Costs

These are usually locked for the year:

- Rent / Mortgage

Target: < 30% of income (Rent vs salary ratio UAE) - Education

Fees + transport + uniforms + activities

(A major factor in Dubai monthly budget for family) - Utilities

DEWA + Empower + Internet + Mobile - Transport

Car EMI + Fuel + Salik + Insurance - Domestic Help

Maid/Nanny salary + visa + insurance (amortised monthly)

If this section is too heavy, no budgeting hack will save you.

Step 3: Create Sinking Funds for Annual Giants

List:

- Flights home

- Car renewal

- School books

- Visa costs

Divide by 12.

These are monthly phantom expenses—treat them as real.

Step 4: Automate on Day One

The moment salary hits:

- Transfer to Sinking Funds

- Transfer to Long-term savings/investments

- Transfer to Fixed bills account

Automation removes emotion.

Step 5: The Lifestyle Envelope

What’s left covers:

- Groceries

- Dining

- Entertainment

- Small indulgences

If this feels tight, the issue is not spending—

It’s structural fixed costs.

Step 6: Quarterly “Creep” Review

Every 3 months:

- Scan bank statements

- Kill zombie subscriptions

- Review delivery app spending

Convenience is the UAE’s biggest silent budget killer.

Realistic Monthly Expenses for a 4-Person Family in Dubai (2026 Snapshot)

(Indicative ranges, varies by area & lifestyle)

- Rent: AED 7,000 – 10,000

- School fees (monthly accrual): AED 3,000 – 5,000

- Utilities & Internet: AED 1,200 – 1,800

- Transport: AED 1,500 – 2,500

- Groceries & dining: AED 3,000 – 4,500

- Sinking funds & savings: AED 3,000 – 6,000

This is why budgeting for monthly expenses UAE must be realistic—not aspirational.

Final Thought: Budgeting in the UAE Is Not About Restriction

It’s about:

- Visibility

- Predictability

- Control

You don’t need to live like a monk.

You need a system that respects how money actually moves in the Emirates.

When budgeting aligns with reality, saving stops feeling painful—and wealth building becomes automatic.

This article is for informational purposes only and does not constitute financial advice. Always consider your personal circumstances before making financial decisions.