For the average UAE resident, the “tax-free” dream often feels like a treadmill. You earn more, yet the bank balance remains stagnant. In 2026, the culprit isn’t usually a single large purchase; it is a systemic “wealth leak” caused by the most expensive convenience economy in the world.

At finfigs, we’ve analyzed the habits of successful UAE savers and compared them with global benchmarks. The “Smart Way” to track spending in UAE isn’t about recording every coffee—it’s about understanding the psychology of the Dirham and mastering the local “lumpy” cash flow.

1. The 2026 UAE Spending Landscape: Why It’s Harder Now

The UAE financial ecosystem is unique. Unlike Europe or North America, where expenses are smoothed out monthly, the UAE operates on massive periodic outflows.

- The Rent Surge: With 2025 seeing a continued 15-20% and 2026 predictions to see 6% rise in prime residential areas, rent is no longer a “bill”—it’s a capital investment that requires 12 months of planning.

The Convenience Trap: Digital adoption in the UAE is among the highest globally. The “one-click” culture of Noon, Talabat, and Careem has decoupled the act of buying from the feeling of spending.

2. The 5 ‘Raw’ Pain Points (And How to Fix Them)

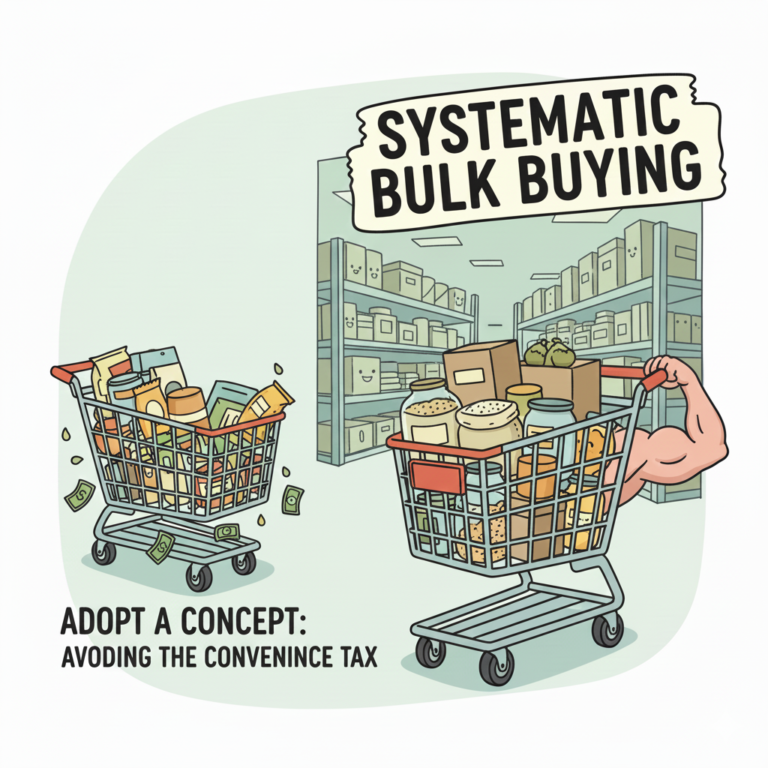

A. The “Invisible” Dirham Leak (The Convenience Tax)

The Problem: Micro-transactions. Small fees—delivery charges, service fees, “convenience” surcharges, and tips—that aggregate into thousands of Dirhams annually.

- The Emotion: Frustration. That “Where did my money go?” feeling at 10:00 PM on a Tuesday.

- The 2025 Data: Recent forum discussions on r/dubai highlight that the average resident spends AED 8,400 per year just on delivery and service fees—excluding the cost of the actual products.

- The ‘Gap’: Standard apps categorize these as “Food.” They aren’t food; they are Laziness Taxes.

- The Finfigs Solution: The “App-Silo” & Friction Strategy To stop the leak, you must stop the automation of your impulses. Finfigs recommends a two-tier approach. First, move all your “Convenience Apps” (Talabat, Noon, Careem, Amazon) to a single, dedicated digital prepaid card (like a secondary bank account or a digital wallet). Load this card with a fixed “Convenience Budget” at the start of the month. Once that card hits zero, the apps stay closed. Second, remove all saved credit card details from these apps. By forcing yourself to manually type in your card number for every AED 5 delivery fee, you introduce “Cognitive Friction.” This 30-second delay allows your logical brain to override the impulse, often saving residents between AED 800 and AED 1,500 monthly.

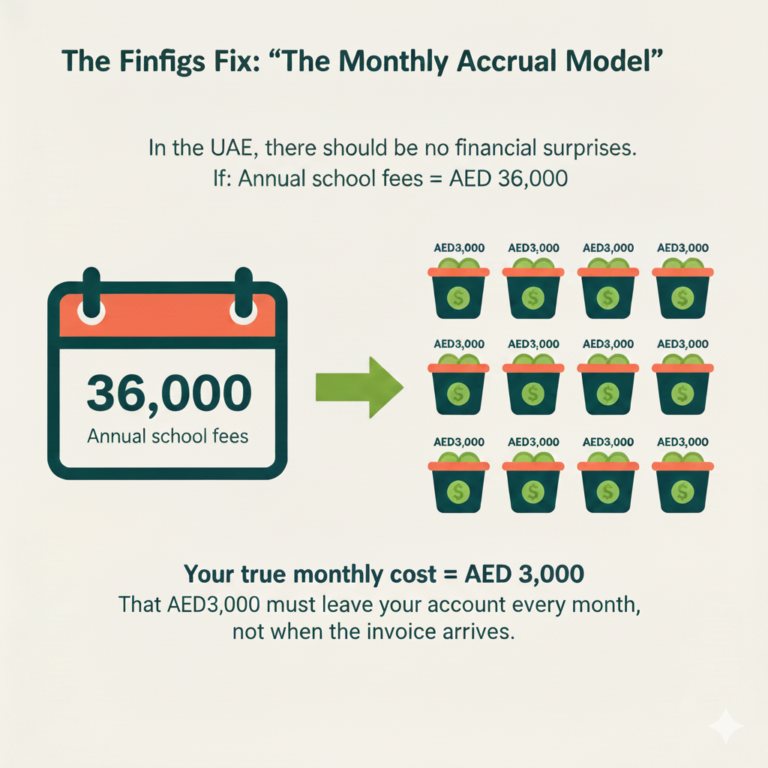

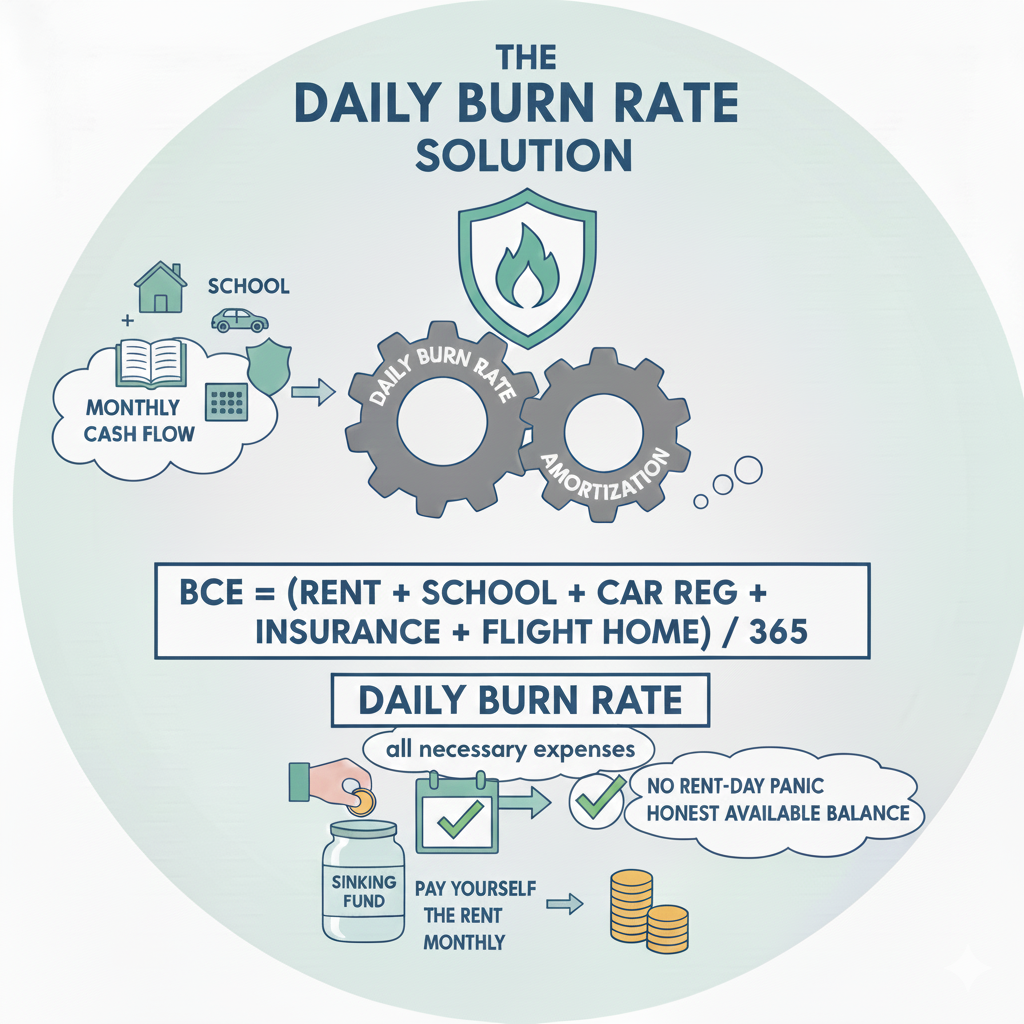

B. The “Lumpy” Expense Trap (Annual vs. Monthly)

The Problem: Expenses that hit once or twice a year: Rent cheques, School fees, Car registration, and the “Summer Flight Home.”

- The Emotion: Anxiety. The looming dread of a 50,000 AED cheque being cashed next month.

- The ‘Gap’: Most tracking advice focuses on “Monthly Cash Flow.” In the UAE, monthly cash flow is a lie. You need a Yearly Cash Flow view.

- The Finfigs Solution: The “Daily Burn Rate” Amortization Finfigs solves this by shifting your perspective from “Monthly Cash Flow” to “Accrual Accounting.” You must calculate your Base Cost of Existence (BCE). Add up every annual non-negotiable: Rent, School Fees, Car Registration, Insurance, and the “Annual Flight Home.” Divide that total by 365. This is your “Daily Burn Rate”—the amount it costs you just to wake up in the UAE. Every month, regardless of when the cheque is due, you must move that monthly portion into a dedicated “Sinking Fund” account. By “paying yourself the rent” every single month, you transform a terrifying 50k cheque into a manageable monthly line item. This prevents the “Rent-Day Panic” and ensures your “Available Balance” is an honest reflection of your spending power.

Get our latest blogs right in your Inbox !!

C. Data Privacy vs. Automation Burnout

The Problem: Residents want the ease of “Mint” or “YNAB” but are rightfully wary of linking UAE bank accounts to third-party apps due to security concerns.

- The Emotion: Confusion. Switching between 5 different apps before giving up and using a mental “guesstimate.”

- The Data/Context: 2025 trends show a resurgence in “Analog-Digital Hybrid” tracking—using secure, local spreadsheets over cloud-linked apps.

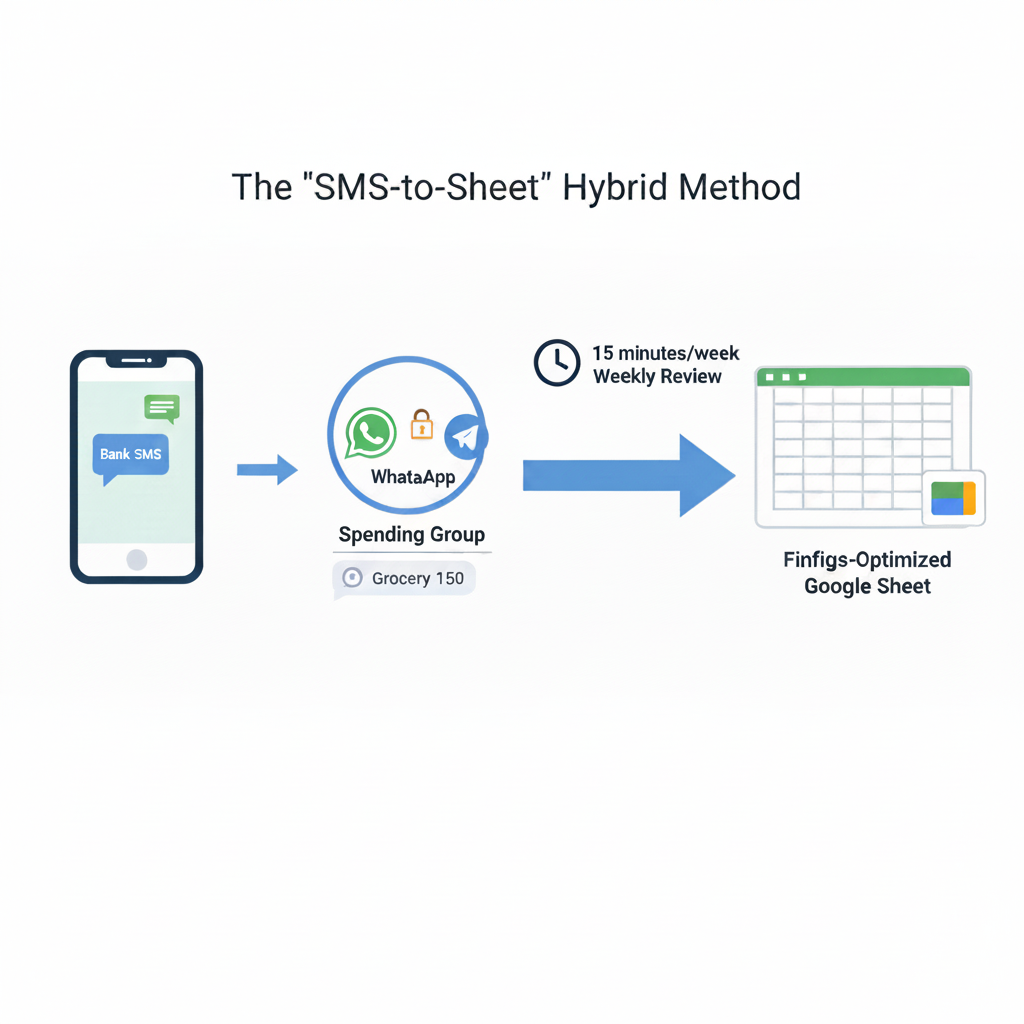

The Finfigs Solution: The “SMS-to-Sheet” Hybrid Method Finfigs advocates for a “Privacy-First” automation loop. Since almost every transaction in the UAE triggers an immediate Bank SMS, use these as your data source. Create a dedicated “Spending Group” on WhatsApp or Telegram containing only you (and your spouse, if applicable). Every time a bank SMS arrives, forward it to this group or type a quick keyword (e.g., “Grocery 150”). At the end of each week, spend 15 minutes transferring these logs into a finfigs-optimized Google Sheet. This method offers the speed of digital tracking with the security of an offline system. It also forces a “Weekly Review”—a ritual where you confront your spending while the memory of the purchase is still fresh, which is the most effective way to change long-term financial behavior.

D. The “Social Currency” Tax (Lifestyle Creep)

The Problem: The pressure to maintain a certain lifestyle for networking or social standing (especially for solo founders).

- The Emotion: Guilt. Knowing you can’t afford the AED 500 brunch but fearing the professional “FOMO.”

- The ‘Gap’: Most experts say “just stop.” But in the UAE, social circles are net-worth circles. You can’t just stop; you have to optimize.

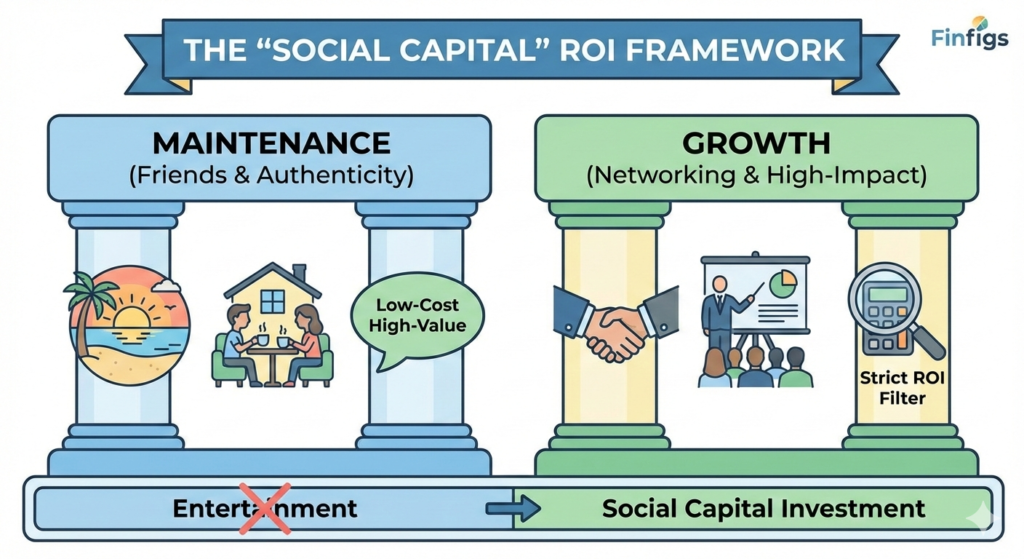

- The Finfigs Solution: The “Social Capital” ROI Framework Instead of the “just don’t go” advice that fails in a social city like Dubai, Finfigs suggests treating social spending as a High-Impact Investment. Categorize your outings into “Maintenance” (friends) and “Growth” (professional networking). For “Maintenance,” suggest “Low-Cost High-Value” alternatives like beach sunsets or home gatherings, which are becoming a major trend in 2025 as residents seek authenticity. For “Growth,” set a strict “ROI Filter”: If an event costs AED 500, ask yourself if it provides a clear networking opportunity or mental health reset. By labeling this as “Social Capital” in your tracker rather than “Entertainment,” you remove the guilt but gain the discipline to choose one high-value event over four meaningless ones.

E. Remittance & Currency Dissonance

The Problem: Sending money home and losing track of the “AED value” vs. the “Home Currency” value.

- The Emotion: Cognitive Dissonance. Feeling wealthy in your home country but “broke” in the UAE.

- The 2026 Trend: With volatile exchange rates, the “Cost of Sending” (fees + spread) is at a 3-year high.

- The Finfigs Solution: The “Net-Worth Mirror” Tracking Finfigs introduces a dual-entry system for remittances. In your primary UAE tracker, the money leaving is tagged as a “Wealth Transfer,” not an expense. Simultaneously, you must track the “Home Account” where that money lands. Using the finfigs investment tracking philosophy, you record the AED 5,000 sent home as the purchase of an asset (e.g., property equity or stocks). When you see your “Home Asset” growing in tandem with your “UAE Outflow,” the psychological reward shifts. You stop seeing your salary as “money that disappears” and start seeing your UAE life as a “Wealth Engine.” This clarity reduces the impulse to spend “what’s left” because you become addicted to watching your global net worth rise.

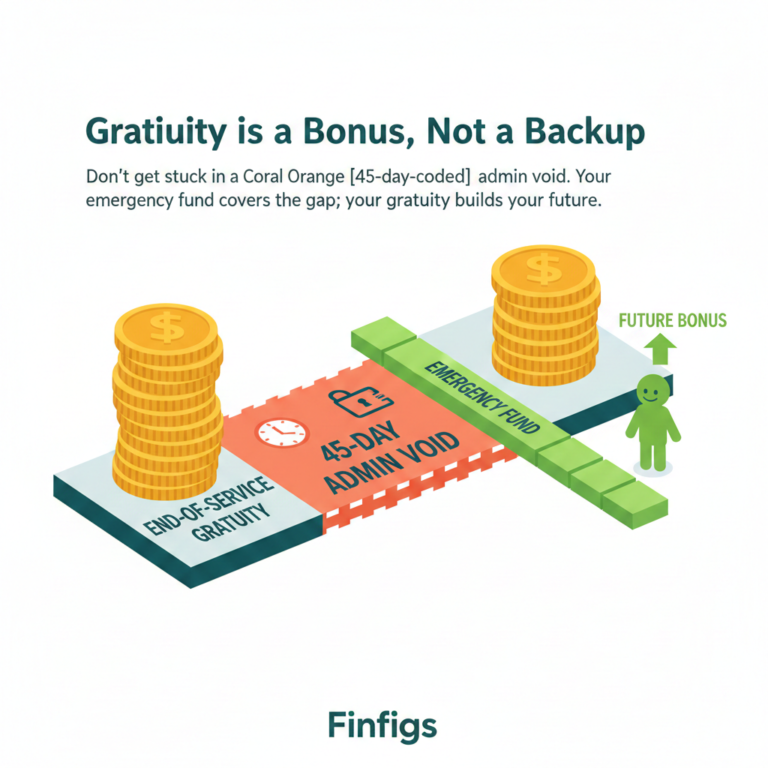

Read our article ‘The 180-Day Shield: Building a Fail-Safe UAE Emergency Fund in 2026‘ on the 180 days shield as emergency fund saved in UAE residents pockets which we recommend as a must have.

The Finfigs “Smart Tracking” Framework: The Burn-Rate Philosophy

Traditional budgeting fails in the UAE because it is reactive—it looks at what you already spent. The Finfigs Smart Tracking Framework is a proactive architecture built on the concept of the “Daily Burn Rate.” Instead of asking if you can afford a purchase today, this framework asks if your lifestyle supports your “Base Cost of Existence.” By categorizing every Dirham into three strategic “Buckets,” you transform your finances from a chaotic monthly cycle into a predictable wealth engine.

Pillar 1: The Survival Bucket (60% Allocation)

This is the foundation of the framework. In the UAE, “Survival” is more expensive than in most global hubs due to the “Lumpy Expense” nature of rent and schooling.

- The Logic: You must calculate your Daily Burn Rate by totaling all annual fixed costs (Rent, School Fees, Car Registration, Medical Insurance, DEWA, and Basic Groceries) and dividing by 365.

- The Action: This 60% is not “available” money. It is pre-committed capital. Finfigs introduces the “Vault Strategy”—the moment your salary hits, you must move the pro-rated portion of your next rent cheque and school term into a separate, “untouchable” bank account. You are essentially paying your future self’s biggest bills in advance.

Pillar 2: The Wealth Bucket (20% Allocation)

This pillar defines your “Exit Strategy” or long-term security. In the UAE expat ecosystem, this is often the most neglected bucket.

- The Logic: Wealth is not what you earn; it’s what you keep. This bucket includes emergency funds, stock market investments, and—crucially for the UAE—Remittances.

The Action: Finfigs treats remittances as a Wealth Transfer, not an expense. By tracking this 20% through the Finfigs upcoming app, you gain a “Mirror View” of your net worth growing in your home country. This psychological feedback loop is vital to prevent “UAE Fatigue” where residents feel they are working hard but getting nowhere.

Pillar 3: The Lifestyle Bucket (20% Allocation)

This is your “Guilt-Free” spending zone. It covers the “Dubai Experience”—brunches, staycations, streaming services, and designer shopping.

- The Logic: Financial discipline without a release valve leads to “Budget Burnout.” This bucket allows you to enjoy the UAE’s world-class offerings without compromising Pillar 1 or 2.

- The Action: Use the “Zero-Balance Rule.” Once this 20% is exhausted, your social season is over until the next payday. By silo-ing this money, you ensure that a weekend at a luxury resort never accidentally “eats” your DEWA payment or your child’s school fees.

The Finfigs Benchmark: While the European “Pay Yourself First” model is popular, the Finfigs UAE model evolves this into “Pay Your Future Cheque First.” This framework ensures that even if you lose your income tomorrow, your survival is funded for months, and your wealth is already working for you.

4. Why Traditional Advice Fails in the UAE

The internet is full of “don’t buy lattes” advice. In the UAE, a latte is AED 25, but a rent hike is AED 25,000.

The missing info: You aren’t failing because you bought a coffee; you are failing because you haven’t accounted for your “Base Cost of Existence.”

- Calculation: (Total Annual Fixed Costs / 365) = Your Daily Burn Rate.

- If your Daily Burn Rate is AED 450, and you spend AED 100 on lunch, you have spent AED 550 today. Does your income support that?

5. Conclusion: Tracking is the Path to Freedom

Tracking isn’t about restriction; it’s about awareness. When you know exactly where your Dirhams are leaking, you stop being a victim of the “Dubai Lifestyle” and start becoming a master of it.

The Finfigs Challenge: For the next 30 days, don’t change your spending. Just name it. Write down every single “Convenience Fee” you pay. You’ll be surprised how quickly your behavior changes when the “Invisible Leak” becomes visible.